Nowadays, QR codes are becoming an integral part of the insurance industry's transformation. For insurers, QR codes not only enhance customer engagement but also significantly improve operational efficiency.

What is a QR Code in Insurance?

In the insurance sector, a QR code is a type of barcode that can be easily scanned using a smartphone camera. This code instantly directs the user to a particular digital destination, such as a webpage, app, or online document.

In the context of insurance, QR codes are used to streamline processes, enhance customer interaction, and provide quick access to insurance information and services. They serve as a bridge between physical documents or advertisements and digital platforms, allowing for more interactive and efficient customer service.

The Benefits of QR Codes in Insurance

1. Enhanced Customer Convenience

QR codes significantly simplify access to insurance services and information. Customers can easily scan a QR code to view policy details, update personal information, make payments, or initiate claims without the need to navigate through complex websites or lengthy customer service processes. This instant access not only saves time but also enhances the overall customer experience.

2. Operational Efficiency

By integrating QR codes into various operational processes, insurance companies can reduce manual entry errors and administrative overhead. QR codes can streamline claims management, from initial reporting to document submission and status updates, allowing for faster processing and reduced operational costs. This also includes speeding up customer onboarding and policy renewals, which can be handled digitally with fewer steps and minimal paperwork.

3. Improved Marketing Effectiveness

QR codes for insurance open new avenues for targeted marketing and customer engagement. By embedding QR codes in promotional materials, insurers can directly link customers to interactive and personalized content, such as videos, special offers, and direct quote tools. This not only increases engagement rates but also allows for better tracking and analysis of marketing campaigns’ effectiveness, leading to more informed marketing decisions.

Applications of QR Codes in Insurance

1. Direct Access to Insurance Policies

QR codes can be embedded in membership cards or policy documents, allowing policyholders to instantly view their insurance details and coverage by simply scanning the code. This ensures that customers always have easy access to their policy information without needing to log in to an account or call customer service.

2. Streamlined Claims Process

Insurers use QR codes on insurance cards or through mobile apps to simplify the claims process. By scanning a QR code, customers can initiate the claims process immediately after an incident, upload necessary documentation, and track the status of their claims, all from their mobile devices.

3. Enhanced Marketing and Customer Acquisition

QR codes for insurance are included in marketing materials like brochures, posters, and flyers to offer potential customers detailed product information, and promotional videos, or direct them to a quote page. This not only enriches the information available to potential clients but also simplifies the process of signing up for new policies.

4. Efficient Payment Solutions

Insurance QR codes are used by insurance companies to facilitate easy and secure payment processes. By scanning a QR code, customers can pay their premiums without the need to enter lengthy payment details. This method reduces errors, enhances security, and improves overall customer satisfaction with the payment process.

How to Create a QR Code for Insurance?

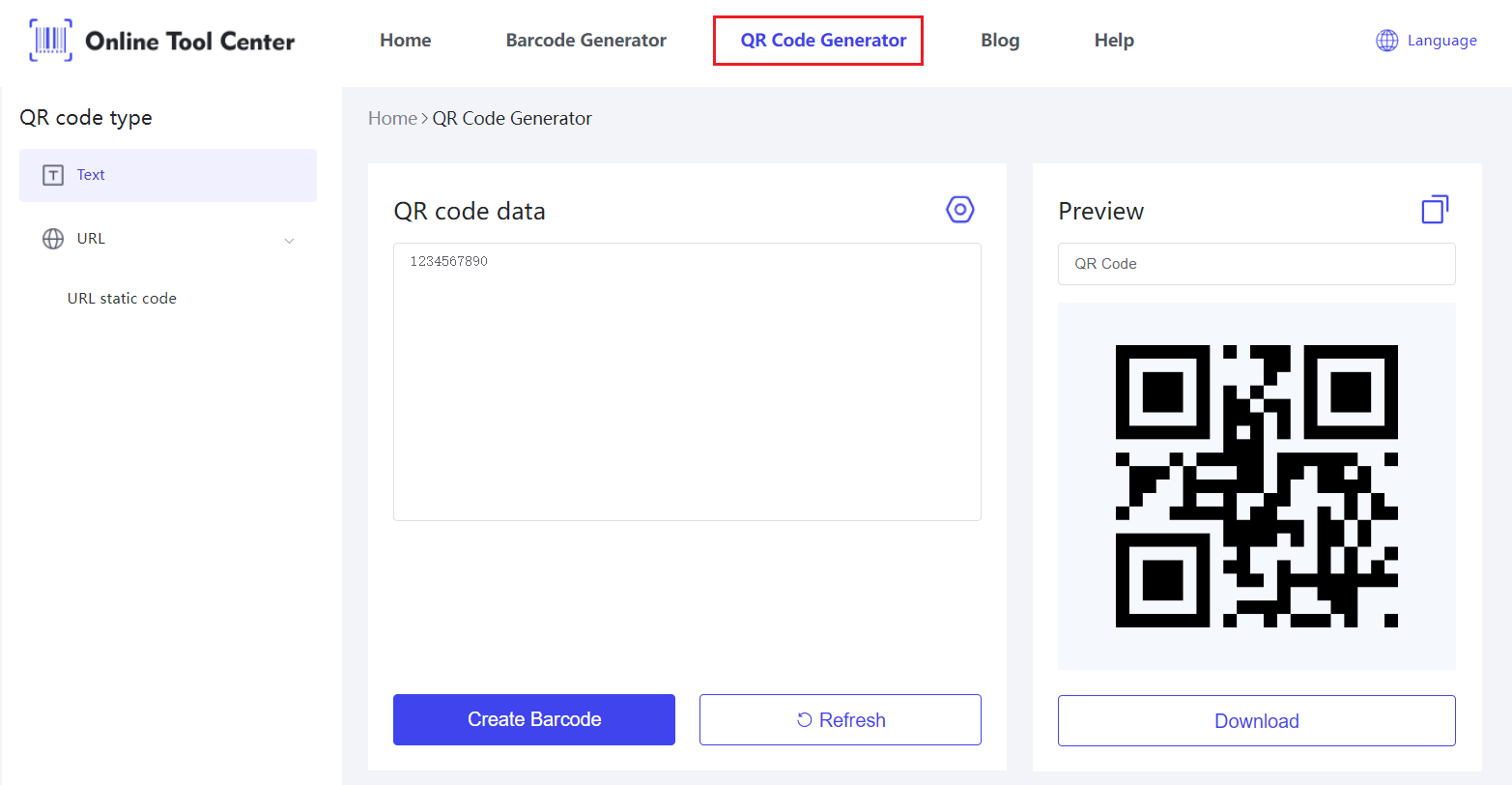

The creation of QR codes involves choosing a free QR code generator that ensures ease of use and effectiveness.

Customize the QR code to reflect the insurance company's branding for better recognition and ensure it directs to a secure, mobile-optimized landing page relevant to the user's needs, like downloading an app, making payments, or accessing policy details.

It's important to test the QR code across various devices to ensure compatibility and functionality before integrating it into marketing materials or documents.

This approach helps maintain consistency, security, and effectiveness in utilizing QR codes within the insurance industry.

FAQs

1. What are QR codes and how do they work in the insurance industry?

QR codes in insurance are digital barcodes that facilitate instant access to insurance services and information. They work by being scanned with a smartphone, directing the user to specific online resources related to their insurance needs.

2. How can QR codes improve customer service in insurance?

QR codes enhance customer service by providing instant access to services, simplifying processes like claims and payments, and ensuring that policy information is easily accessible. This leads to faster service delivery and improved customer satisfaction.

3. What are the best practices for implementing QR codes in insurance marketing?

Best practices include using dynamic QR codes for flexibility, ensuring that QR codes link to mobile-optimized pages, integrating QR codes seamlessly with existing marketing strategies, and continuously tracking their performance to optimize their use.

In conclusion, QR codes significantly transform customer interactions and operational processes within the insurance industry.

Start integrating QR codes into your processes today and experience the benefits of a digitally transformed insurance landscape. Visit our QR code generator at onlinetoolcenter.com for effective QR code solutions tailored to the insurance industry's needs.